With 11 years team experience, Aalfa Fx Trade is one of the most secure, fast and trustworthy trading platforms in the industry.

- Home

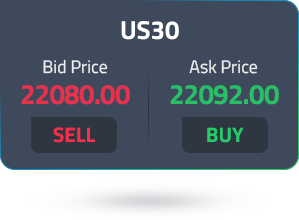

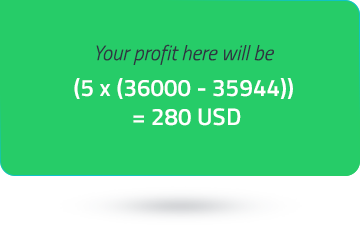

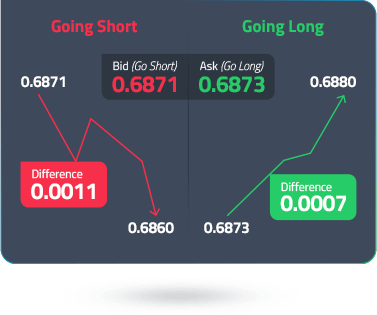

- Trading

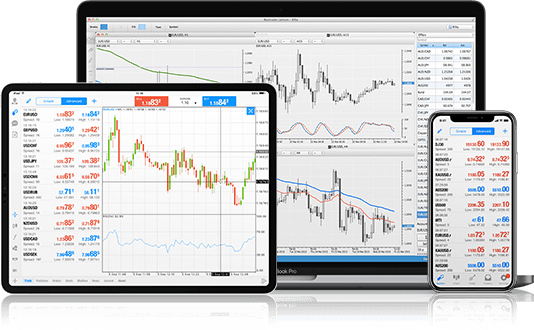

- Platforms

Aalfa Fx Trade's Official Terminal for Android

Download he Android version of our official trading terminal and trade world markets, anytime and anywhere.

Aalfa Fx Trade's Official Terminal for Desktop

Download official trading terminal desktop for Windows experience the best of trading.

Aalfa Fx Trade's Official Terminal for iPhone

Experience a seamless transition between your desktop and smartphone while trading. Download the official trading terminal for iPhone today.

- For Client

- For Partners

- About us

ABOUT US

Aalfa Fx Trade sets high standards to its services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles.

- Promotions